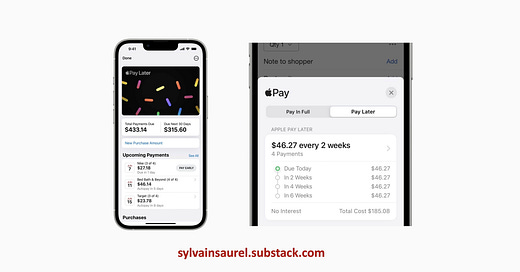

With Apple Pay Later, Apple Is Getting Into the “Buy Now Pay Later” Business.

Apple continues its diversification strategy.

The fractional payment sector continues to be the subject of a fierce battle. And after having pushed the banks, it is now the turn of the Fintechs to see their market being nibbled away by the big groups. The American giant Apple announced on June 6, 2022, during the keynote of the WWDC 2022 the launch of its own solution, Apple Pay Later, to attack th…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.