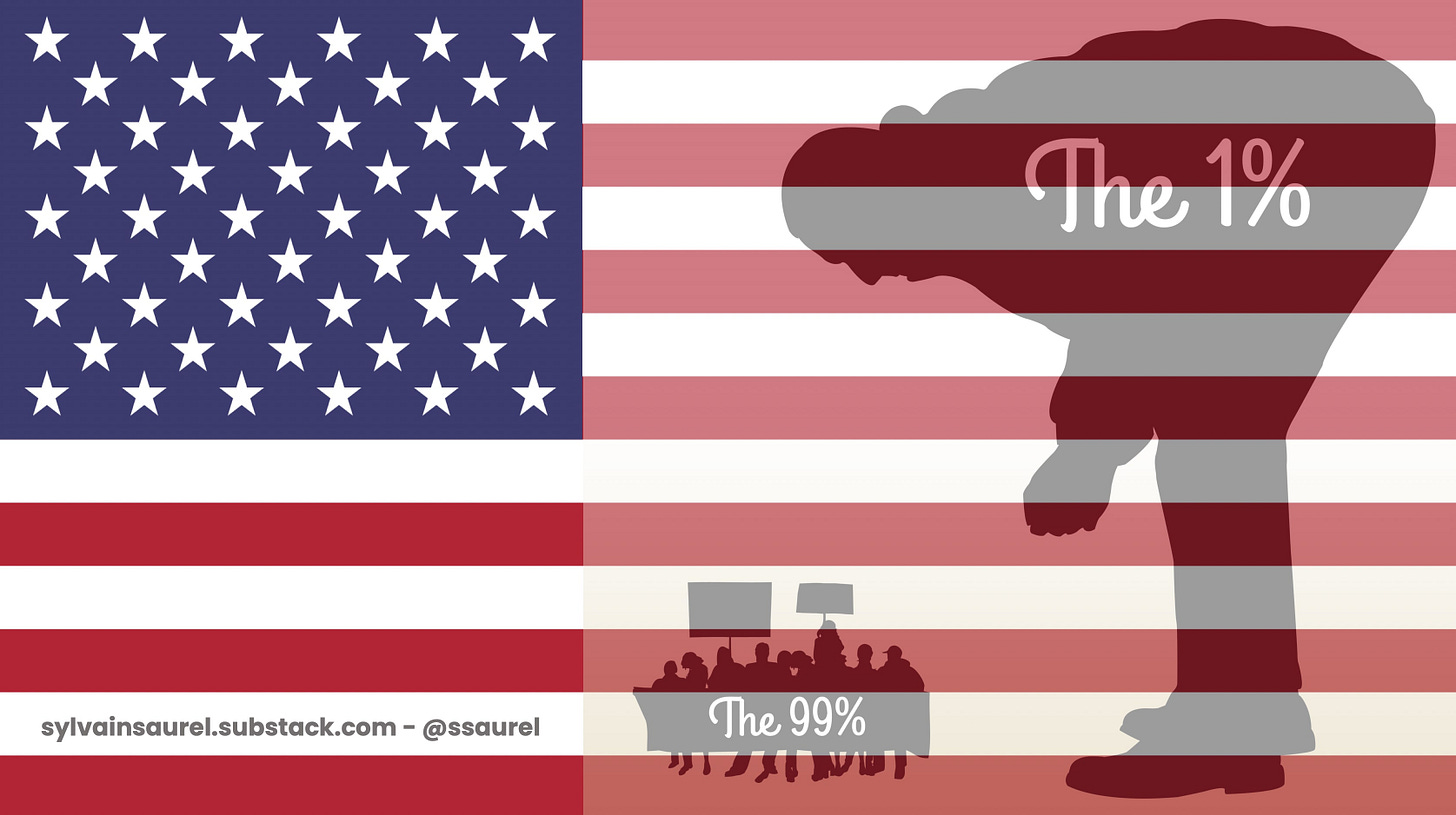

Why Taxing the Ultra-Rich and Raising the Minimum Wage Is the Way for a Better America

Increasing Inequality in America Hinders Growth.

Inequality in America is particularly obvious when we look at the evolution of the income of the American population since the 1980s. According to figures published by Emmanuel Saez and Gabriel Zucman in “Wealth inequality in the united states since 1913: Evidence from capitalized income tax data”, the income of the bottom 90% of the population has stag…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.