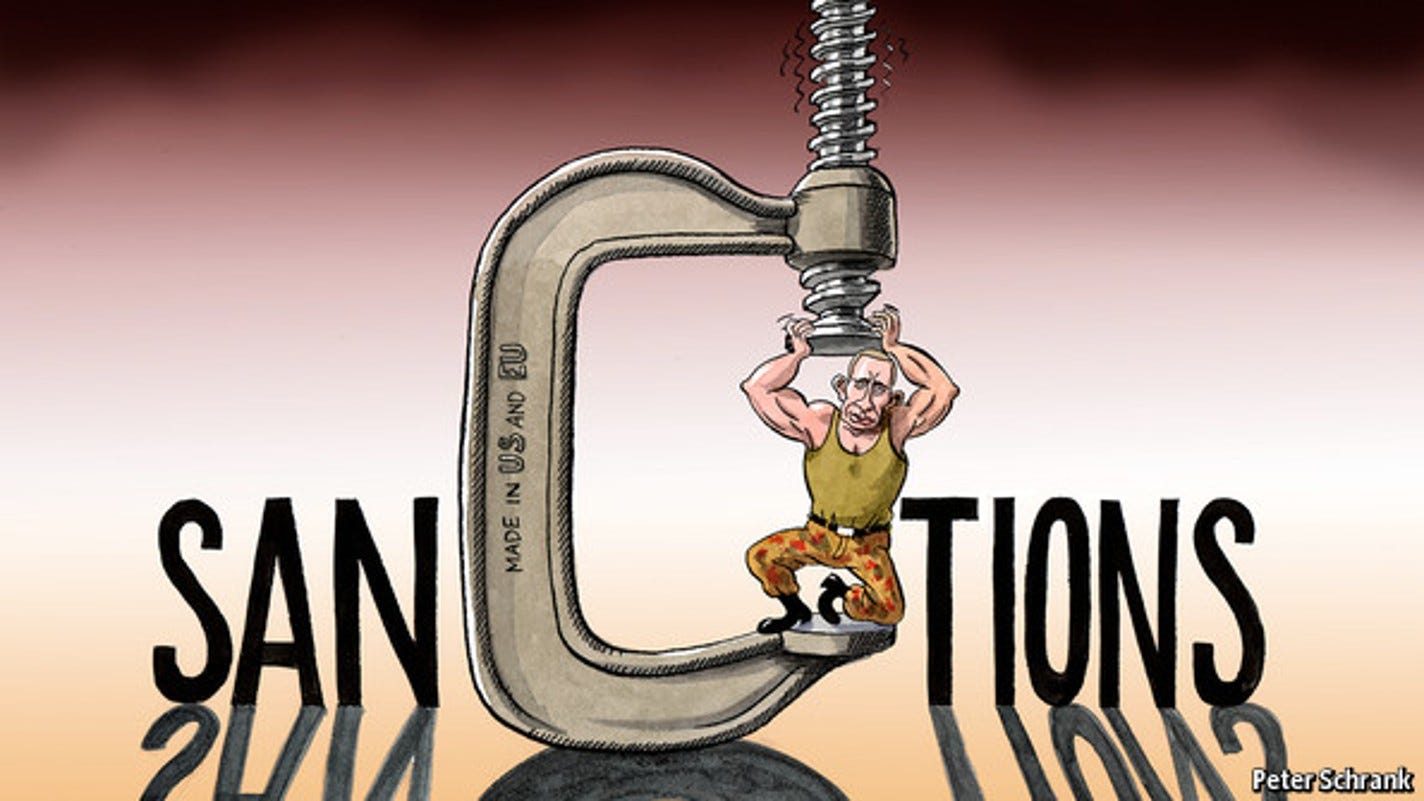

Western Sanctions Against Putin Are Working and Hampering the Russian War Effort.

Essential reminder while the Kremlin propaganda tries to convince Europeans otherwise.

Over the past few weeks, you have probably heard the following phrase, just as I have: “Europe is shooting itself in the foot.”

This is the story that is spreading in a part of the European opinion, coming from TV sets and some economists: the EU would have taken sanctions against Russia that would turn against it, without bothering Moscow. And to explai…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.