Unpopular Opinion: The Stock Market Can Only Go Up With a Recession and Rising Unemployment.

The Fed is currently pursuing this objective at all costs to curb inflation.

Inflation is proving more persistent than expected. Even with lower oil prices, central banks are now concerned about a wage-price spiral. The Fed has made it clear that it will continue to fight inflation. It can only do so by pursuing a restrictive monetary policy which can only lead to a sharp rise in unemployment. The stock markets will be happy when people lose their jobs or wages stop rising.

According to researchers at Johns Hopkins University, we will have to wait until we see at least 5 million unemployed people in the United States.

The logic of the stock market is sometimes very unclear to investors who are not involved in it day in and day out. Why do stock markets go down when good numbers are released and why do stock markets go up when there is only bad news?

More jobs mean higher interest rates

On Friday, October 7, 2022, the stock markets fell sharply after a nascent rally that had caused a slight rise. The reason? Another very encouraging job report showed that the U.S. economy added 263,000 jobs in September 2022.

Long-term interest rates immediately rose. Investors knew enough. This meant that the Fed was likely to keep raising interest rates. High-interest rates are bad for indebted businesses and consumers who have less ability to borrow.

Lower productivity growth means more inflation

There is another danger lurking around the corner. The Economist has calculated that productivity growth is failing to keep up with inflation, without taking energy into account. So underlying inflation is far too high. We urgently need to become much more productive. But we haven't. Even if energy prices are brought under control, inflation will remain stubbornly high, according to their calculations.

Lower inflation means more unemployment

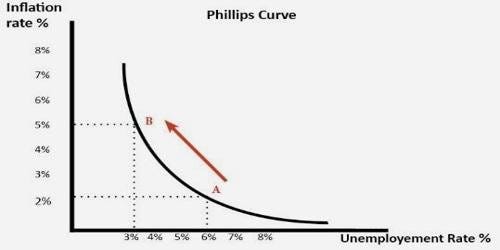

The economists among us will remember the Phillips curve from the macroeconomics class. The curve is named after New Zealand economist William Phillips; the original version shows that there is an inverse relationship between nominal wages and unemployment. If inflation rises, it means unemployment falls. If inflation goes down, unemployment goes up.

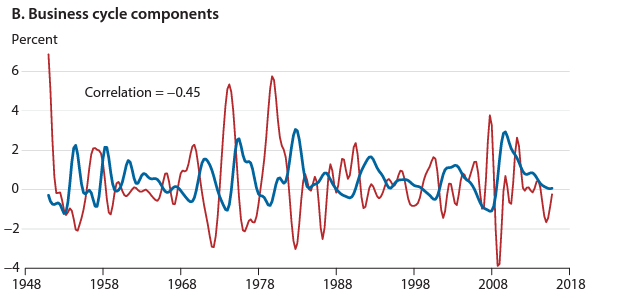

Although this curve has been questioned by some, it is still very much alive. A recent study by the Federal Reserve Bank of St. Louis makes this clear, as shown in the chart below. You can see that inflation (= red line) is high when unemployment (blue line) is low. When inflation is low, unemployment is high.

So the message is clear. Increase unemployment if you want to lower inflation.

So there should be no automatic indexation of wages

Even if unemployment does not rise dramatically, wages will certainly have to fall or at least stop rising. Automatic wage indexation in some countries is therefore everything that Fed watchers and therefore the European Central Bank want to avoid.

If the current shortage of workers remains chronic, nominal wages can only continue to rise. So even if we can avoid rising unemployment, central banks are desperate to make sure that labor is paid less. Again, the message is clear.

No wage increases if you want to fight inflation.

5 million more unemployed to come to America

A recent analysis by Larry Ball, a macroeconomist at Johns Hopkins University, in collaboration with Daniel Leigh and Prachi Mishra of the International Monetary Fund (IMF), even puts a figure on this phenomenon.

If inflation is to fall to 2%, the US unemployment rate must reach 6.5%. Today, the U.S. unemployment rate has fallen to 3.5%. The Wall Street Journal called this the scariest document it has read in years. When you consider that 158 million people are working in the U.S., you can charge yourself the bill: that would mean adding 5 million unemployed.

Of course, when it rains in the United States, it also rains in Europe. Those who think that the stock markets will recover quickly are mistaken. It will take a while before we find an ideal entry point into the stock market.

Bank of America may have given us a clue: the U.S. is expected to lose 175,000 jobs every month in the first quarter of 2023. This first rise in unemployment could lead to lower inflation and therefore an easing of the Fed's monetary policy.

Some reading

Xi Jinping’s Achilles Heel Is Not Political, but Economic. However strong his power, he will be judged by the economic results.

Bitcoin Solves the Number One Problem for All Investors. When you understand this, you will have taken a big step.

The Four Levels To Achieve Self-Sovereignty With Bitcoin. Buying Bitcoin is just the first step in a long and wonderful journey.

Why Bitcoin Is Your Best Weapon Against Censorship by Money on the Internet. Decentralization is the answer to the problem of censorship on the Internet.

What Would NATO Do If Putin Used Nuclear Weapons? The Former CIA Director Assures That It Would Eliminate Russian Forces in Ukraine. America could not stand by and do nothing.