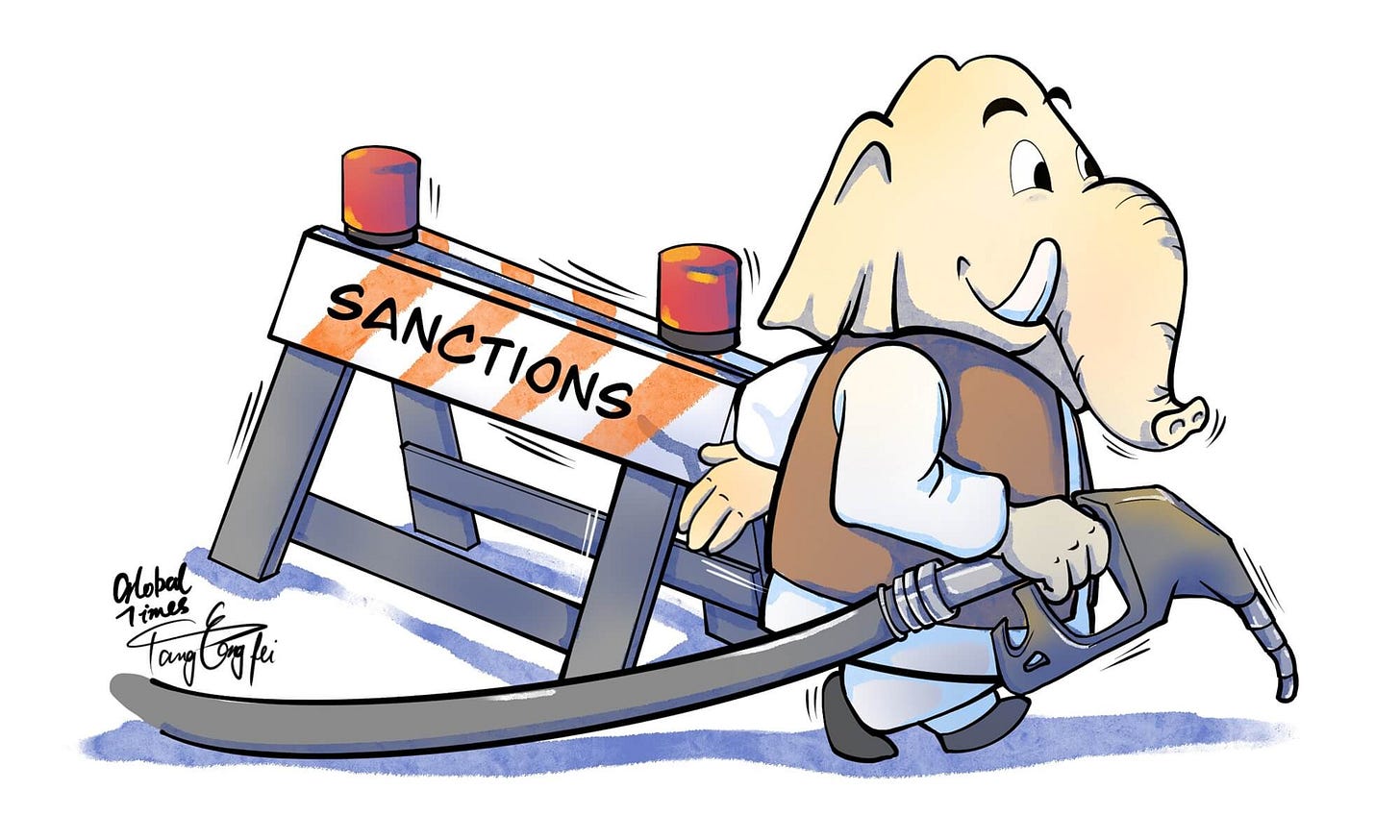

This Is How Russian Oil Will Reach Europe and Continue To Finance Putin’s War.

The embargo on Russian oil can be bypassed via India.

In theory, the Europeans will no longer buy oil produced in Russia. The EU-27 have decided to reduce their imports by 90% by the end of 2022 for crude oil and by the beginning of 2023 for refined products such as diesel. In reality, it will not be so clear-cut, because it will be impossible to know where the oil processed into fuel co…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.