The Worst-Case Scenario: What If Donald Trump Put Pressure on the Fed to Blackmail Europe Over the Dollar?

Europe's central bankers are already contemplating the worst for the years ahead.

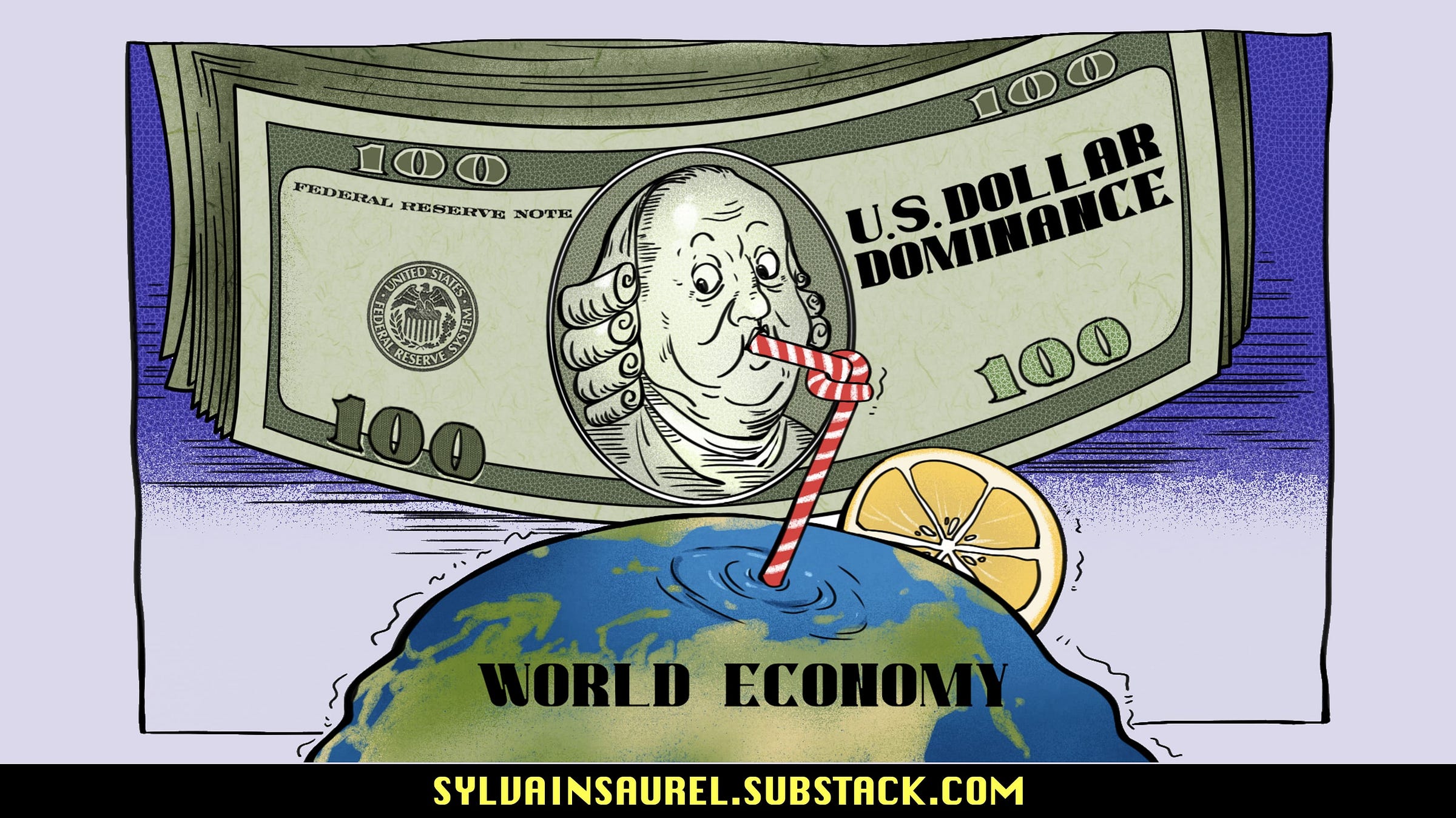

In the 60s, Valéry Giscard d'Estaing, then France's Finance Minister, proclaimed loud and clear that the safe-haven value of the U.S. dollar stemmed from an exorbitant privilege: that of allowing the U.S. to finance its deficits by issuing its currency, thus escaping the economic constraints faced by other countries when balancing their external accounts.

He was right, and today, it's no secret.

As Treasury Secretary under Barack Obama, Timothy Geithner used to emphasize that having the dollar, the world's leading currency, is a privilege that carries with it responsibilities towards the rest of the world. To paraphrase Uncle Ben in Spiderman: “With great power comes great responsibility”.

Unfortunately, it's not clear that the new Trump administration, which has just come to power, shares this view or is fully aware of what America's great power with the dollar entails.

This is hardly surprising, given that with Donald Trump, anything goes!

The American president wants to turn the dollar into a weapon exclusively serving America's interests, and scenarios considered the most improbable in the past are now beginning to be envisaged and feared in Europe.

While America Is Determined To Accumulate As Much Bitcoin As Possible, Europe Must React As Quickly as Possible To Avoid Being Left Behind.

Bitcoin will become a strategic monetary instrument for Nations in the years to come.

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.