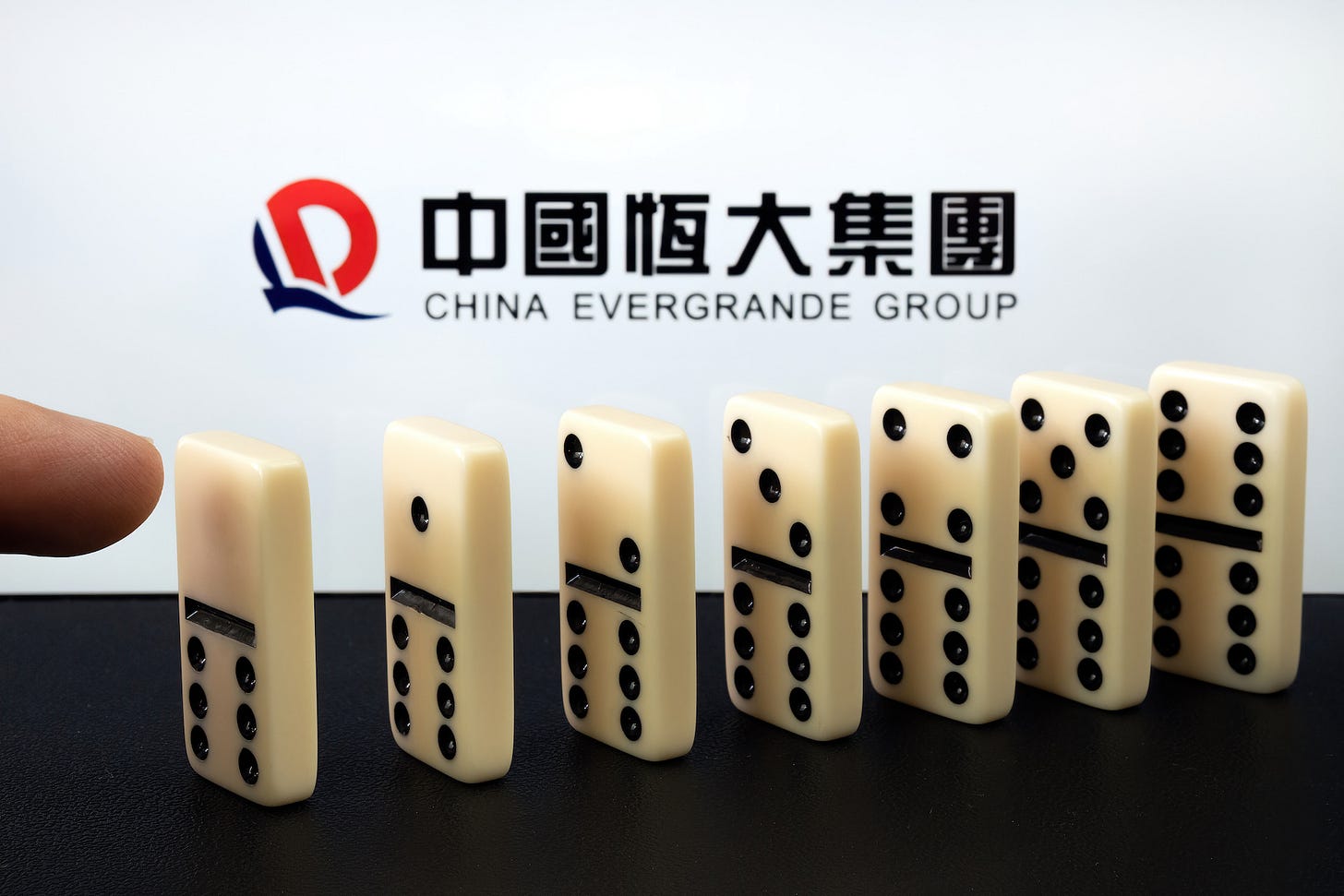

The Six Cases That Agitated the Financial Markets in 2021

#2: Archegos and the flaws of the “Familly Offices”.

The year 2021 will have been marked by its share of cases that will have agitated the financial markets. Nothing abnormal, since this is what happens every year. In this article, I'll look back at the six cases that made the biggest impression on me in 2021.

This is an arbitrary choice on which you will probably not agree with me entirely. That's fine be…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.