The Silicon Sultanate: Inside the $15 Billion Nexus of Trump, Crypto, and Emirati Power.

How a $500 million crypto injection and a presidential pardon paved the way for a 500,000-chip AI revolution—unmasking the high-stakes fusion of the Trump family business and American foreign policy.

This is a narrative that reads like a geopolitical thriller, where the lines between state diplomacy, private interests, and disruptive technologies blur into a fog of digital dollars and silicon. At the center of this imbroglio: Donald Trump, his family, and a Gulf state with outsized ambitions: the United Arab Emirates (UAE).

The recent report by the Wall Street Journal (WSJ) has sent shockwaves through Washington, revealing a complex architecture of funding and political decisions that raise a fundamental question: Is American foreign policy becoming an extension of the Trump family’s portfolio? As AI chips become the new “black gold” and cryptocurrencies redefine global finance, the Washington-Abu Dhabi axis is taking an unprecedented turn, blending familial interests with national security.

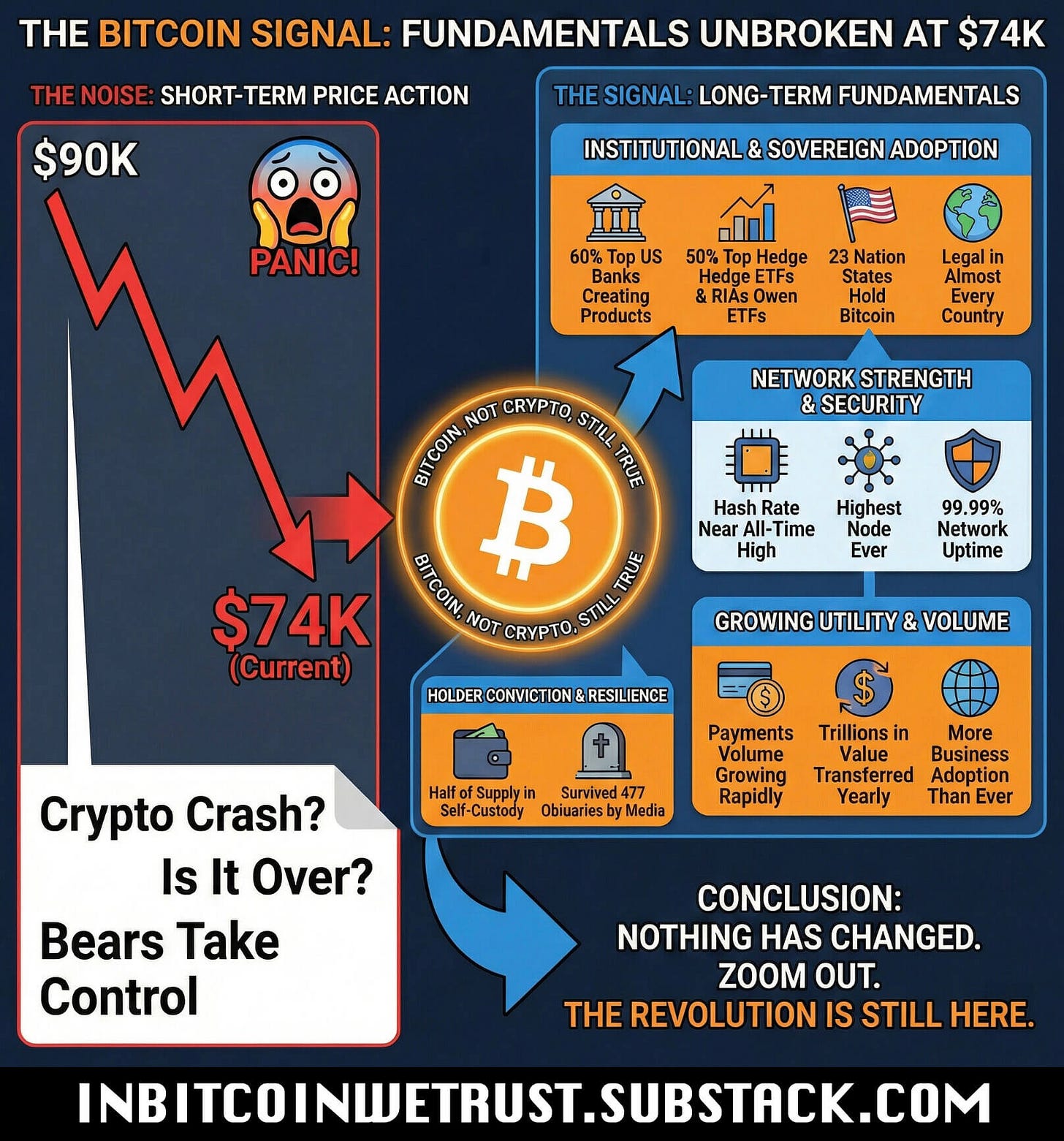

The $74K Noise: Why Bitcoin’s Signal Has Never Been Louder.

Cut Through the Noise: Why the Unstoppable Fundamentals of the Bitcoin Revolution Are Louder Than Ever at $74,000.

I. The World Liberty Financial Affair: A $500 Million Investment

It all began with a foray into Decentralized Finance (DeFi). In December 2024, as the presidential transition was in full swing, Eric Trump was spotted in Abu Dhabi. Officially, he was attending a cryptocurrency conference. Unofficially, the groundwork for a massive deal was being laid to propel the family project: World Liberty Financial (WLFI).

The Opaque Structure of Aryam Investment

Just one week after that visit, two entities named Aryam Investment 1 were created two days apart: one in Abu Dhabi and the other in Delaware. This “mirror” structure is typical of financial setups seeking to facilitate cross-border capital transfers while benefiting from the discretion of Delaware’s corporate laws.