The Silent Reversal: The Chart Signal That Spells the End of a 40-Year Financial Order.

The future of money, the future of savings, lies where it always has: in hard assets that cannot be inflated away by political expediency.

In the frenetic world of financial analysis, charts and graphs flash across our screens with dizzying speed. We see daily stock movements, weekly inflation reports, and quarterly GDP figures. Analysts dissect every wiggle, every tick, desperately searching for an edge. Yet, every so often, a chart emerges that transcends the daily noise. It doesn’t just depict a market trend; it reveals a tectonic shift in the very foundation of global finance.

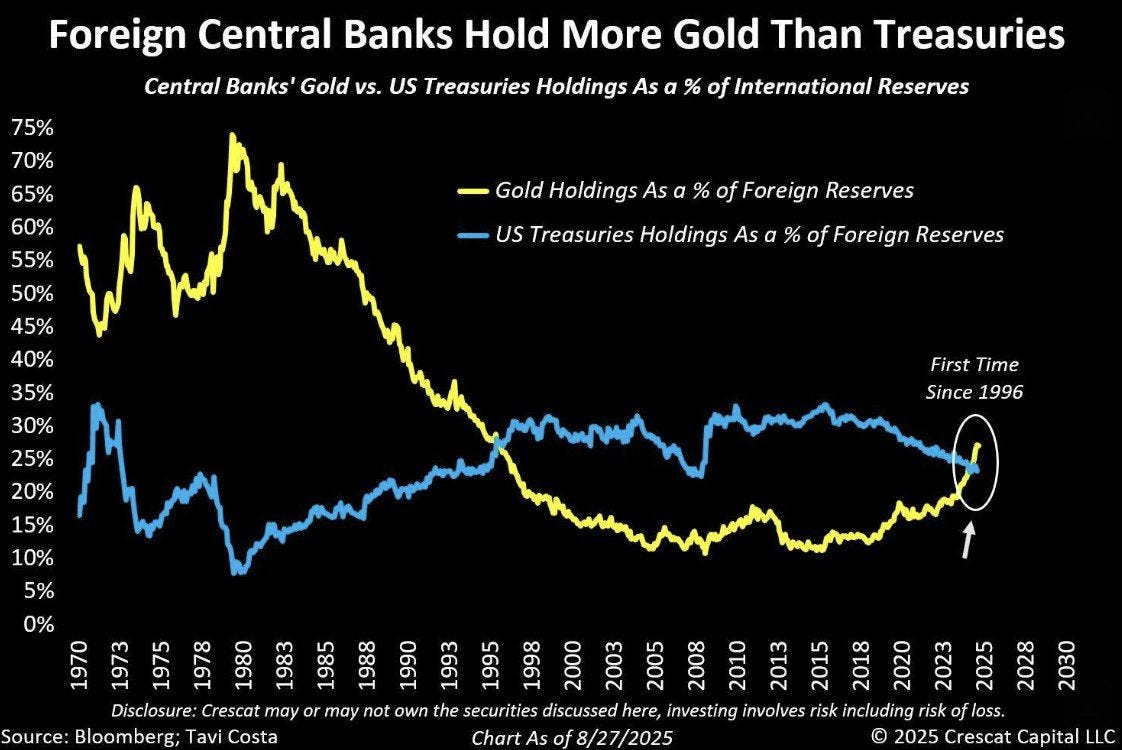

Currently, everyone is sharing this chart. It plots the reserve asset holdings of the world’s central banks.

In simple terms, it’s a ledger that shows where foreign nations store their money. When a country like China, Japan, or Saudi Arabia exports more than it imports, it accumulates a trade surplus, typically in U.S. dollars. This surplus can’t just sit in a checking account; it must be invested in assets of the highest quality and safety. For generations, the choice has boiled down to two primary contenders: Gold, the timeless store of value, and U.S. Treasury bonds, the bedrock of the modern financial system.

The chart tells a stunning story of a 40-year cycle, a great financial migration that is now dramatically reversing. But what everyone is missing, what lies buried beneath the surface of the crisscrossing lines, is the most important signal of all. It’s a signal that doesn’t just predict the future of interest rates, but the future of money itself.

The Unavoidable Collision: Why One System Must Die for Bitcoin to Win.

Jeff Booth is not just making a prediction; he is describing the fundamental choice of the 21st century.

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.