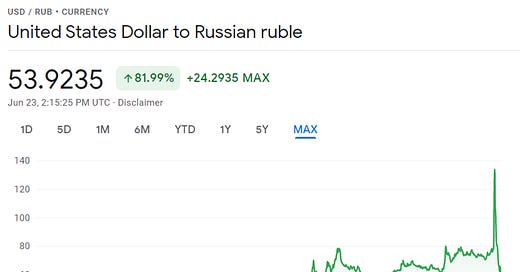

The Ruble Is the Best Performing Currency of 2022 Ahead of the USD, but This Is of No Use to Russia.

The hardest part is yet to come for Vladimir Putin's Russia.

A little more than one hundred and twenty days after the beginning of the war in Ukraine, European countries have continued to reduce their oil purchases from Russia. However, Russia has hardly felt the effects. The reason is to be found in India and China.

Chinese imports of Russian oil increased by 28% in May 2022 compared to April 2022. India, which u…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.