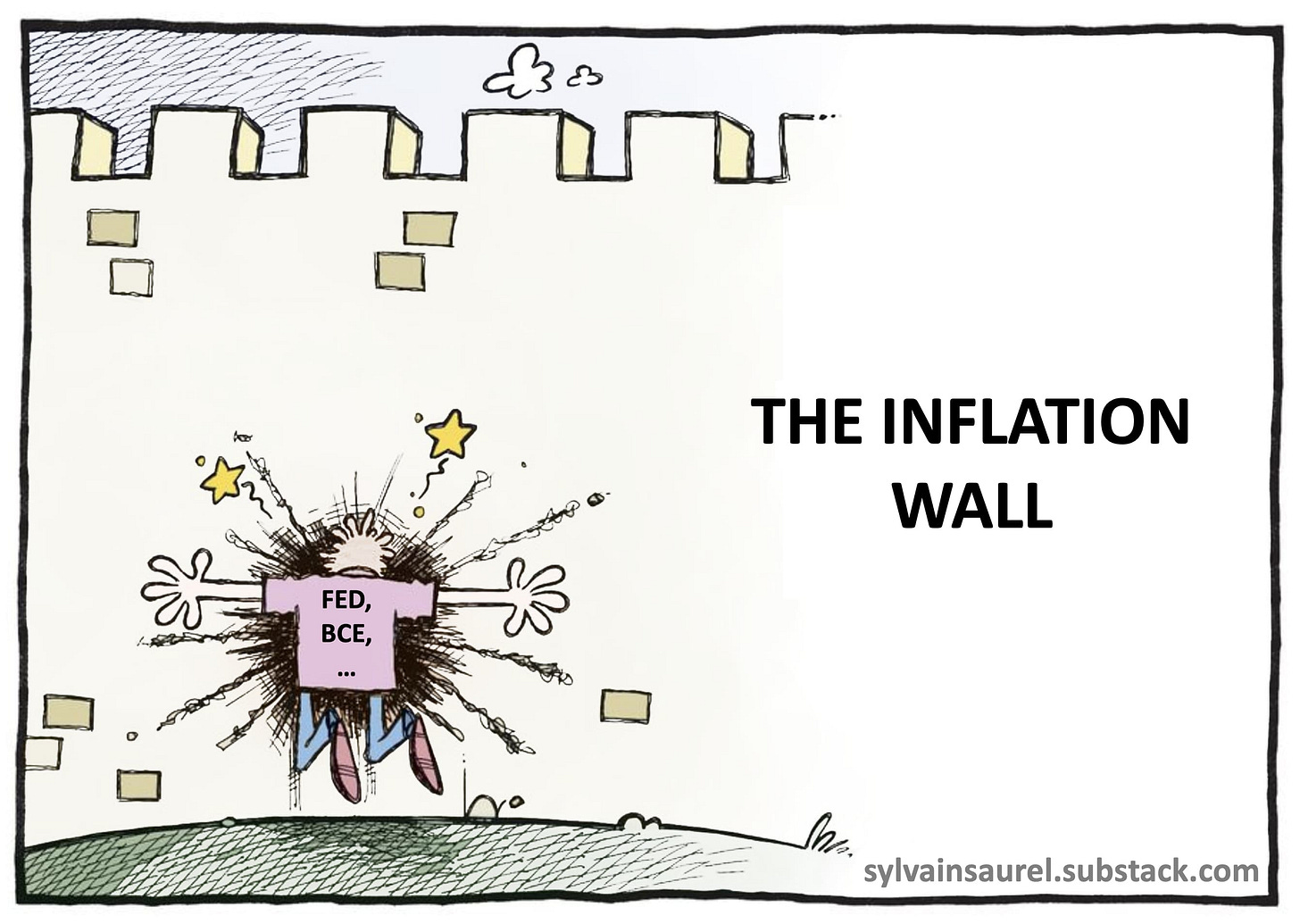

The Inflation Wall Is Too High – Can Interest Rates “Increase Lower”?

Rates already seem to be capitulating, even though the escalation had barely begun.

The central bankers have tried. But no! Interest rates came back down, after trying to rise a bit. Inflation seemed out of reach. Too high, too late ...

And after all, why do it? Inflation is so far away now: “there's no point in sowing in the sand”, said the investors, like Alain the lucid philosopher. In the United States, in Eue, and in France in part…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.