The Great XRP Deception: Why You Are the Exit Liquidity for a Failing Project.

Do not be fooled by the paid influencers, the manipulated headlines, or the desperate hope for a 100x return.

In the feverish, often irrational world of cryptocurrency, narratives are king. Fortunes are built not on tangible value, but on the promise of a future that may never arrive. For nearly a decade, one of the most persistent and seductive narratives has been that of XRP, the digital asset created by Ripple Labs. The story is simple and alluring: XRP is the “banker’s coin,” the chosen one destined to revolutionize global finance, streamline cross-border payments, and make its early investors fabulously wealthy as every major financial institution on the planet adopts it.

There's just one problem: it’s a multi-billion dollar illusion.

The market, blinded by slick marketing and the desperate hope for a “cheaper Bitcoin,” is missing the fatal flaws woven into XRP’s very DNA. The truth is stark and uncomfortable for its holders: banks will NOT use XRP. The future of institutional digital assets is taking shape, and it revolves around the only truly decentralized, neutral, and secure asset ever created: Bitcoin. Banks, when they move, will use dollars and other fiat currencies fully backed and collateralized by Bitcoin.

It’s time to pull back the curtain and expose the hidden flaws, the cynical business model, and the fundamental untruths that underpin the XRP ecosystem. Stop investing in a scam. You are not an early adopter; you are Ripple's exit liquidity.

Not All Sh*tcoins Are Created Equal. There Are Even Worse Ones! XRP Is a Perfect Example.

Like the worst Sh*tcoin, XRP falls into a category of its own, which we could call Scam Coins.

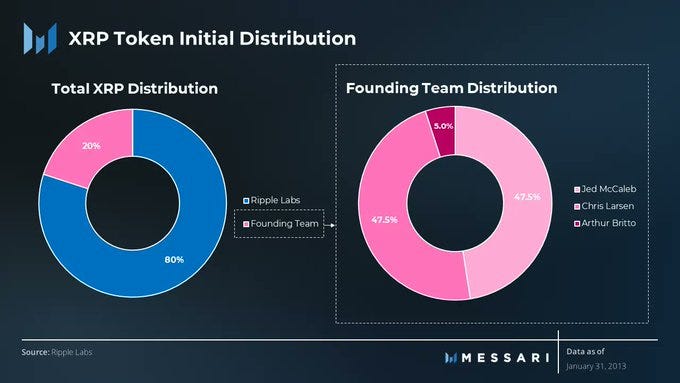

The Original Sin: Centralization and the Pre-Mine

The first and most damning flaw of XRP is its origin story. Unlike Bitcoin, which emerged organically from an anonymous creator and is “mined” into existence by a decentralized network of participants, XRP was created in a lab. It was 100% pre-mined, meaning all 100 billion XRP tokens were created at once by its founders.

Think about that. Ripple Labs and its founders simply conjured the entire supply out of thin air. From day one, they held the vast majority of it. This isn’t decentralization; it’s a digital monarchy. Ripple Labs, a private, for-profit company, sits at the center of this ecosystem, holding a colossal war chest of the very asset it promotes.

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.