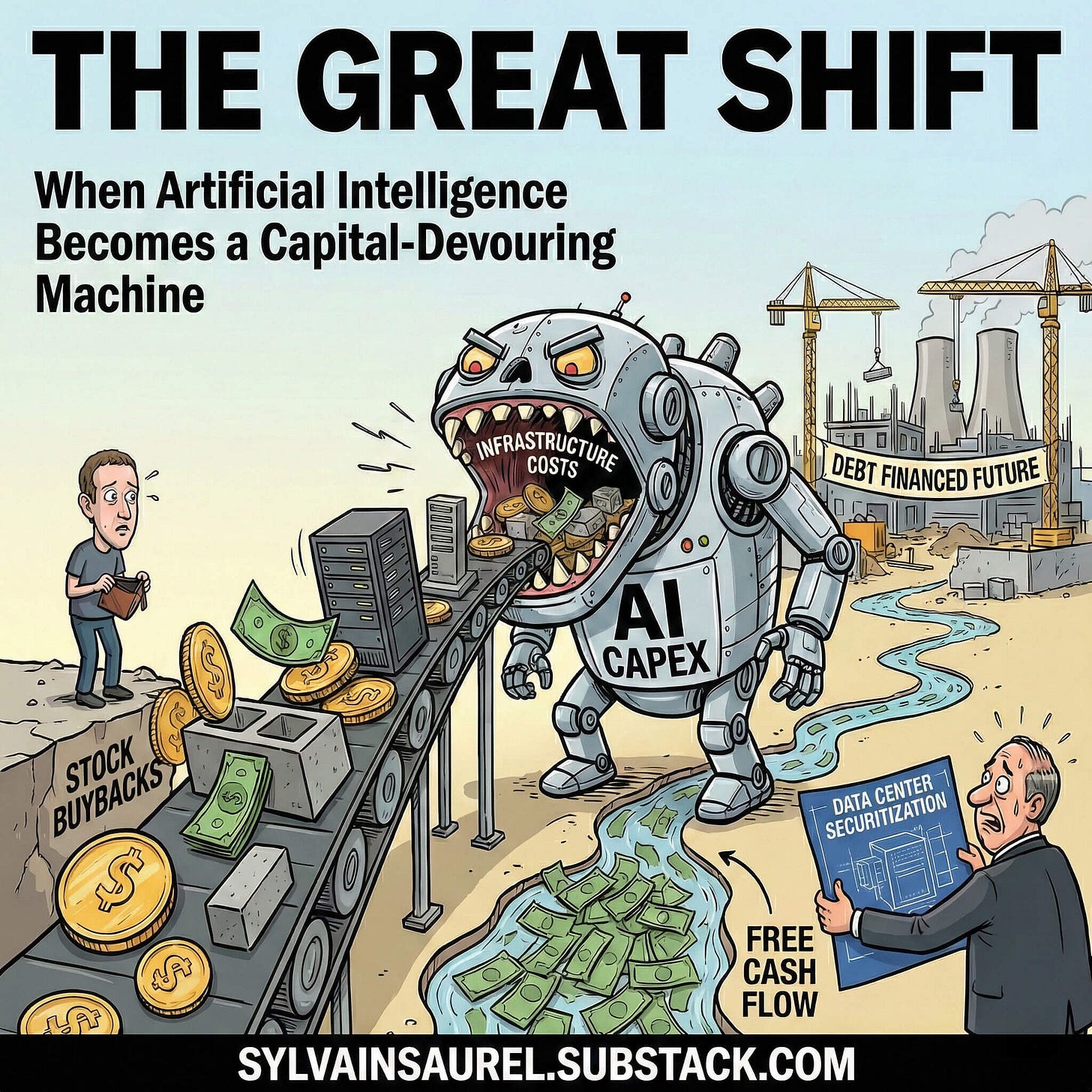

The Great Shift: When Artificial Intelligence Becomes a Capital-Devouring Machine.

From Software Margins to Concrete Debt: The Financial Rewiring of the AI Era.

There are market moments that pass unnoticed by the general public, drowned out by the constant stream of financial news, but which resonate like a thunderclap for the astute observer. The recent release of Meta’s results is one of those moments. It wasn’t simply an earnings presentation or an update on daily active users. It was an admission, an implicit demonstration of a structural rupture: for the first time, one of the most profitable giants in history signaled that its CAPEX (capital expenditure) was now absorbing the entirety of its cash flow, to the point of completely halting stock buybacks for the quarter.

This signal is colossal. It marks the end of AI’s financial innocence and the beginning of a new, infinitely more complex and perilous era. We are witnessing a silent but tectonic shift in how the technology cycle is financed. AI is no longer just a software promise; it has become a voracious industrial monster that demands a complete rewrite of global financial rules.

I. The End of the Self-Financing Model

For the last decade, Big Tech (Meta, Google, Microsoft, Amazon) lived in a “financial paradise.” They enjoyed insolent operating margins, fortress balance sheets, and free cash flows so gigantic that they could afford everything: unlimited R&D, strategic acquisitions, and above all, massive returns to shareholders via buybacks and dividends.

When the race for generative AI began, the market assumed this model would endure. It was thought that these companies could absorb the explosion in infrastructure costs with their “deep pockets.” Investments increased, certainly, but they initially seemed compatible with cash generation.