The Dollar Is Our Currency, but It’s Your Problem – The American Hyperpower Is Back.

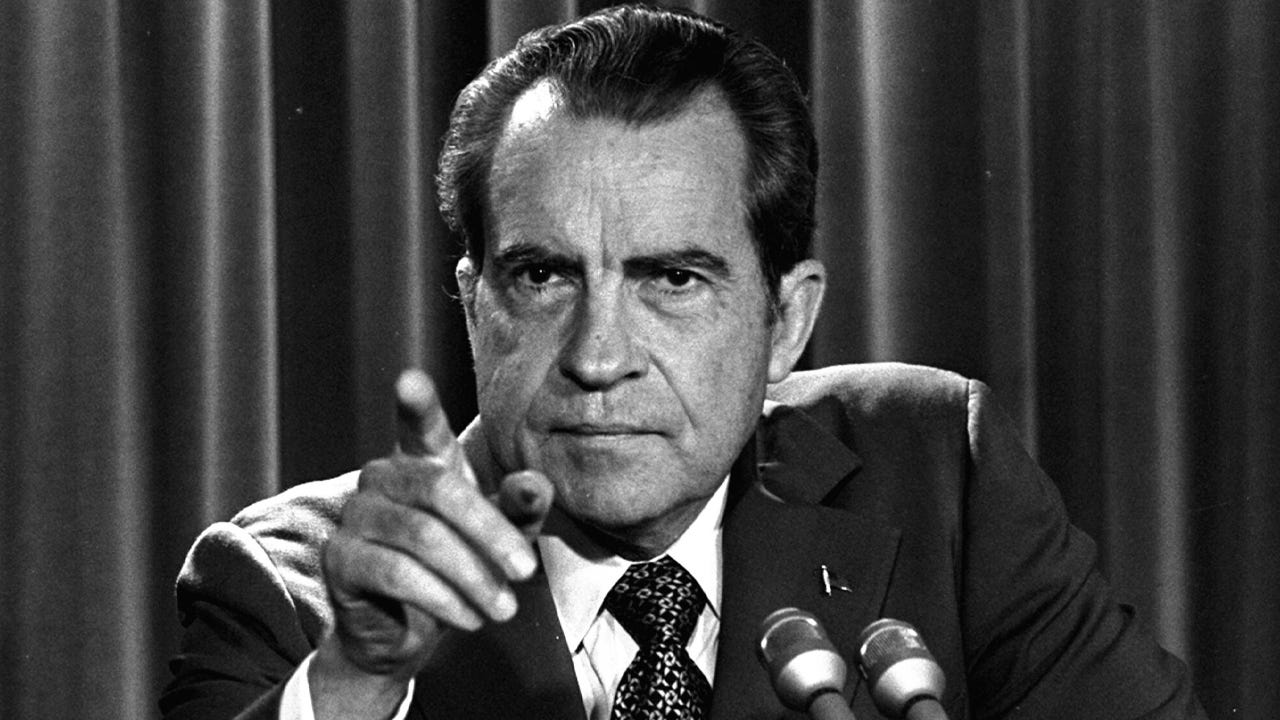

This quote from John Connally is more relevant than ever in 2022.

The American dollar is becoming scarce because the whole world wants and needs it. This problem - recurring since the 1960s - of the scarcity of the US currency is an incredible headache for countries indebted to this currency as soon as it appreciates, as their debts and interest expenses increase in the same proportion.

We have been reliving this type …

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.