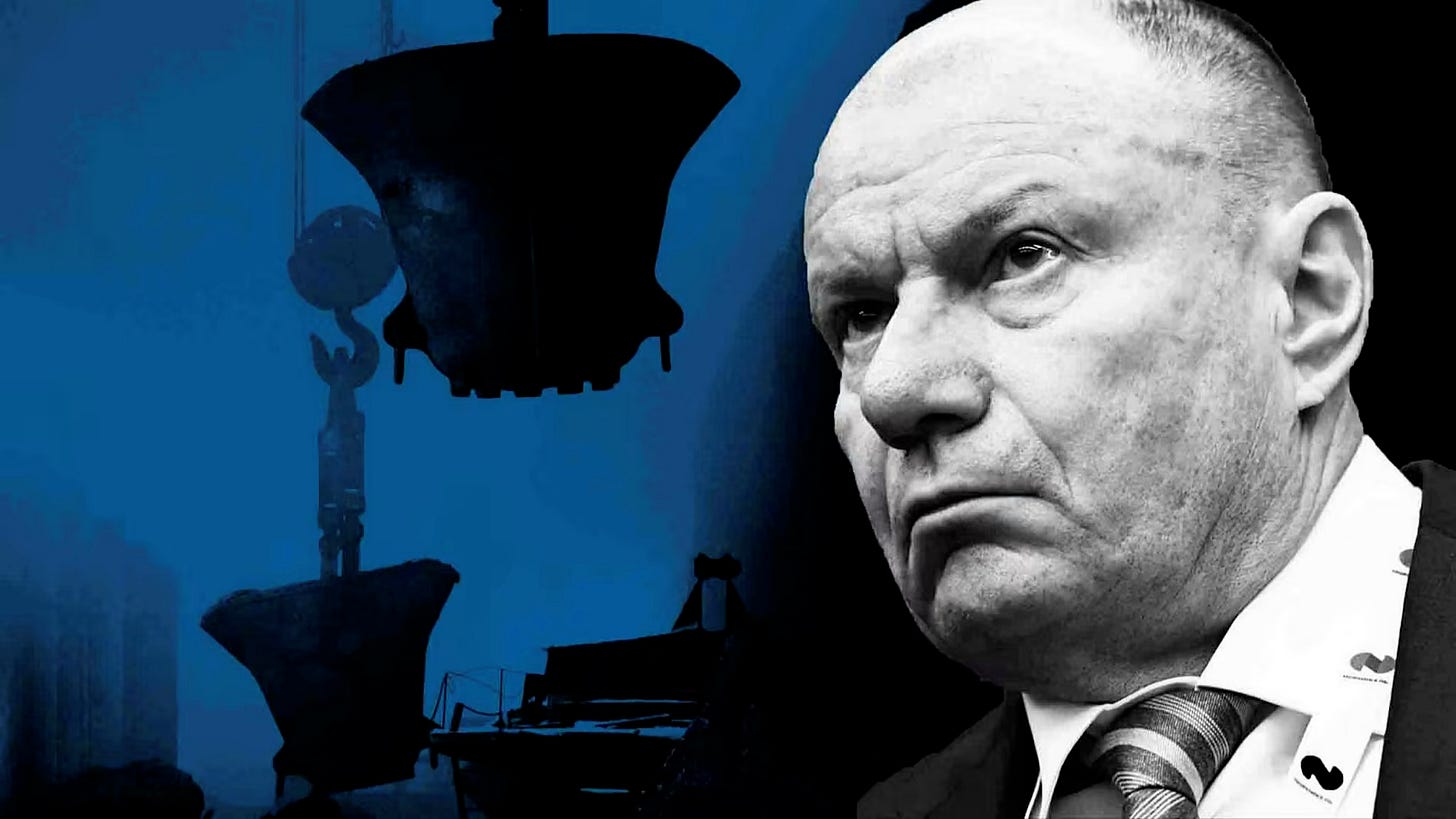

Still Unsanctioned by America, Vladimir Potanin Is Extending His Influence to Banks in Russia.

All under the blessing of his protector Vladimir Putin.

At the end of March 2022, I already told you about Vladimir Potanin, the Russian nickel oligarch, who remained strangely absent from the US, EU, or UK sanctions list. As the second half of May 2022 has begun, Potanin is still protected. This allows him to extend his influence on the banking sector in Russia.

Far from politics, immersed in business, Vladi…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.