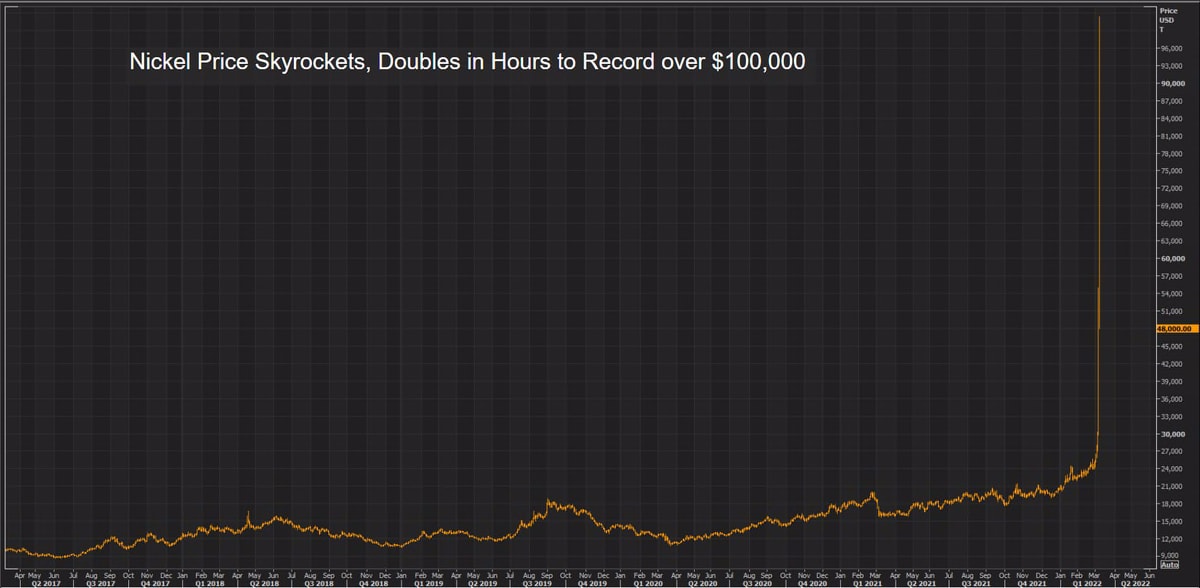

Nickel Is the New Trendy Meme Token – How the Price of Nickel Went From $30K to $100K in Just Two Days

When short selling still wreaks havoc.

The London Metal Exchange was a mess on March 8, 2022. The price of nickel increased three and a half times in two days to reach the incredible price of $100,000 per ton:

This is an unprecedented move in the history of the 145-year-old London institution.

Extraordinary circumstances call for extraordinary measures, as the London Metal Exchange decided to …

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.