American debt topped $35T in 2024.

The days when a debt-to-GDP ratio over 100% was taboo are long gone in America. This disastrous trend has spread to the rest of the world since America issues the world's reserve currency in the form of the US dollar.

When we recall Thomas Jefferson's words, we can imagine that he would be outraged to be living in 21st-century America:

“And to preserve their independence, we must not let our rulers load us with perpetual debt. We must make our election between economy and liberty, or profusion and servitude. If we run into such debts, as that we must be taxed in our meat and in our drink, in our necessaries and our comforts, in our labors and our amusements, for our callings and our creeds, as the people of England are, our people, like them, must come to labor sixteen hours in the twenty-four, give the earnings of fifteen of these to the government for their debts and daily expenses; and the sixteenth being insufficient to afford us bread, we must live, as they now do, on oatmeal and potatoes; have no time to think, no means of calling the mismanagers to account; but be glad to obtain subsistence by hiring ourselves to rivet their chains on the necks of our fellow-sufferers.”

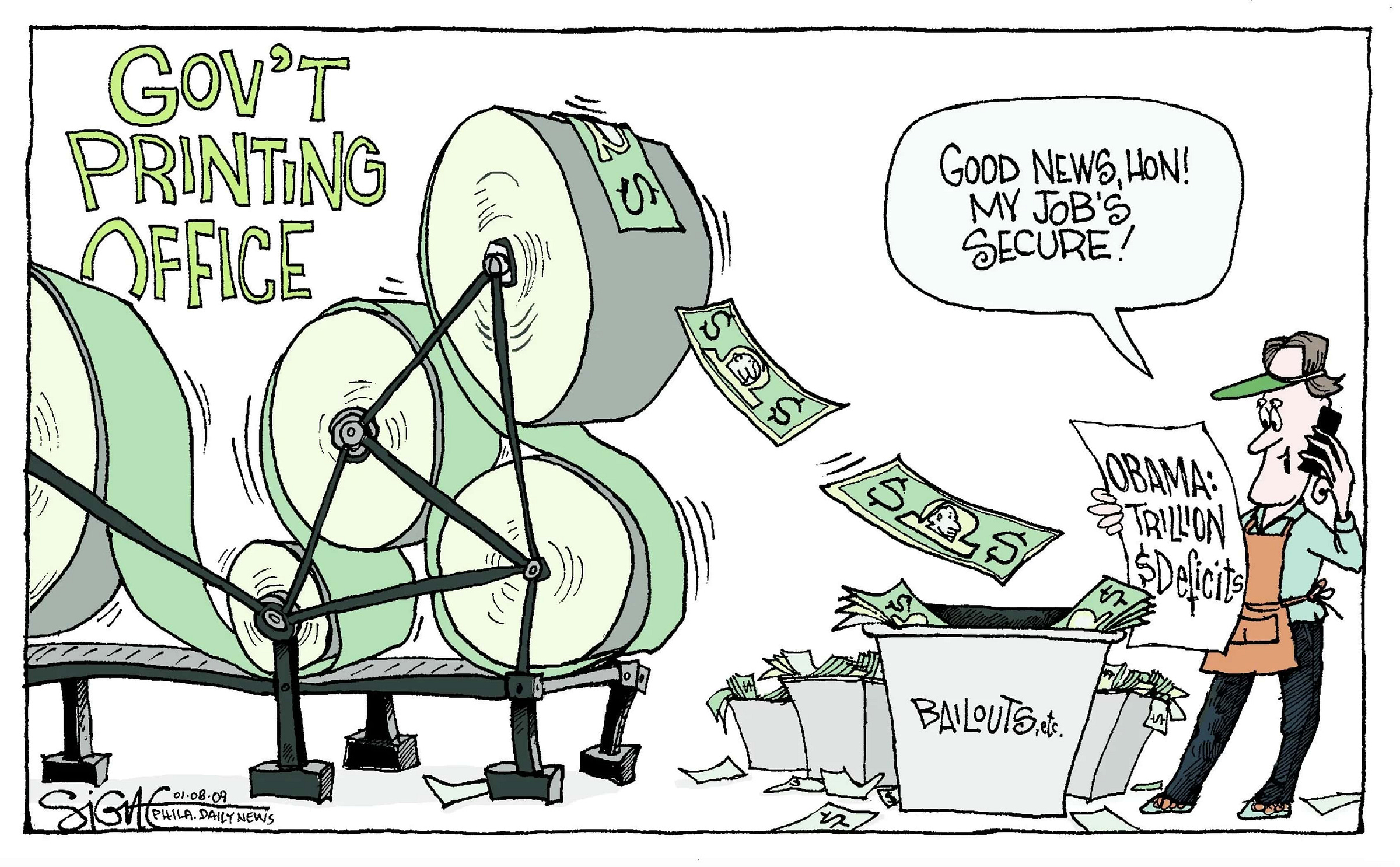

Frequently, you may read or hear that America is turning the printing press back on. This gives the general public the false idea that America has huge money-printing machines that it can turn on and off at will.

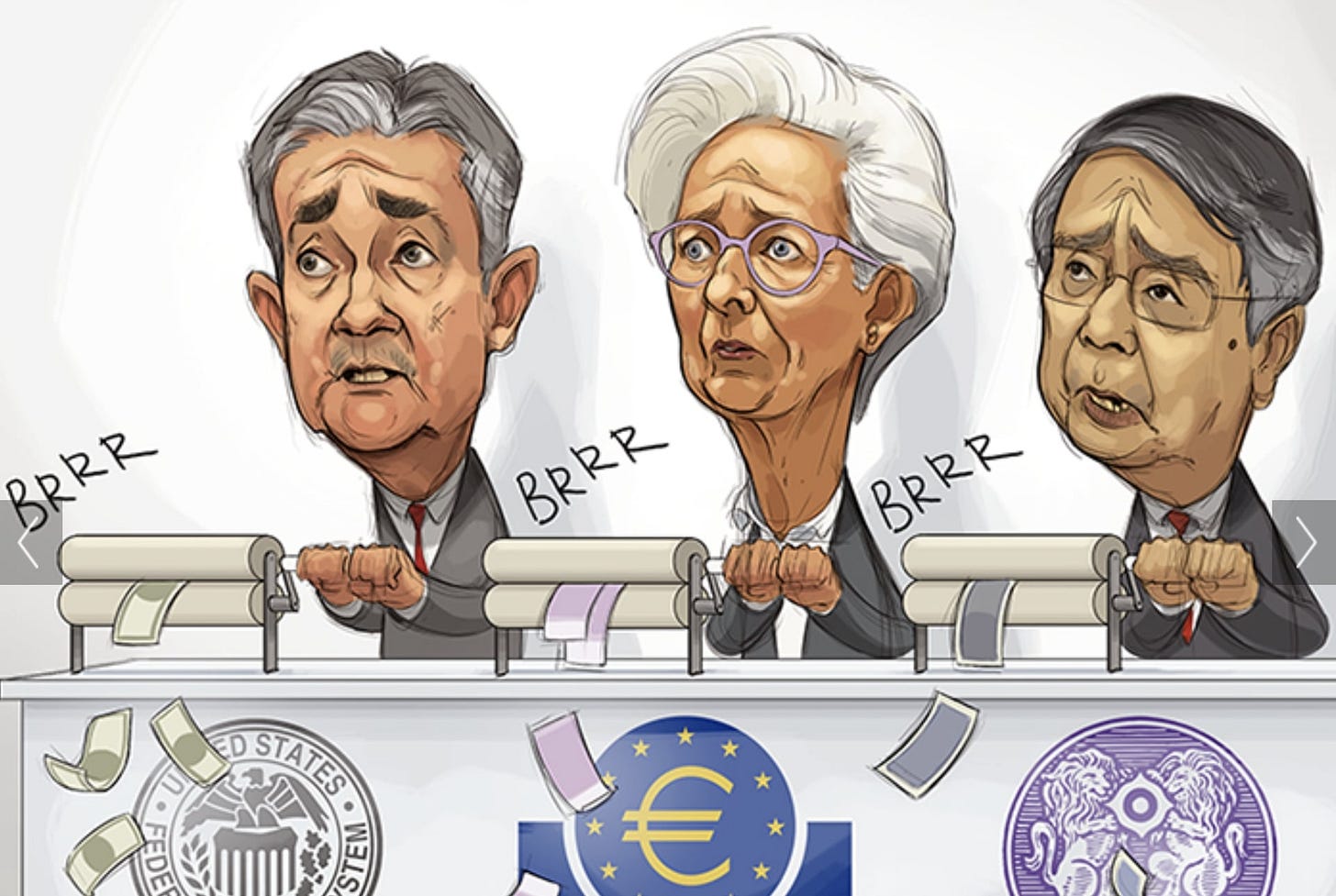

Memes of this kind about the central bankers of the world's major economic powers can often be seen flourishing on the Internet:

The reality is obviously different, and in what follows, I propose to explain in detail how money is printed. An essential reminder for all those who want to better understand how today's monetary and financial system works.

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.