JP Morgan, Citigroup, Bank of America, and Wells Fargo All Want a Piece (the Biggest!) of the Stablecoin Pie, Which Could Reach $2,000 Billion by 2028.

Tether has been warned: the American financial giants are entering the stablecoin race.

For a long time, the giants of traditional finance have left the field wide open to cryptoasset specialists in the stablecoin market. The situation is clearly changing, and the biggest banks are now sharpening their strategies. JP Morgan, Citigroup, Bank of America and Wells Fargo are working behind the scenes on a common stablecoin, according to the Wall Street Journal.

This stablecoin would be issued via a consortium, with the support of payment players such as Zelle, a P2P2 payment operator, or The Clearing House, a real-time payment network, according to the WSJ.

The aim is obvious: to offer a credible, regulated alternative to the crypto behemoths Tether (USDT) and Circle (USDC), which currently dominate the market.

Such eagerness may seem sudden, but it owes nothing to chance. It coincides with the progress in the US Congress of the so-called Genius Act, which would open up the issuance of stablecoins to regulated entities, whether banks or not. The bill put forward by the Trump administration, currently being examined by the Senate, proposes a strict framework: bond reserves, reinforced supervision and a framework for bank issuance.

This text is seen by many as the missing link between traditional finance and cryptocurrencies. According to Standard Chartered, the law could boost the stablecoin market from $240 billion to $2,000 billion by 2028, if adopted en masse.

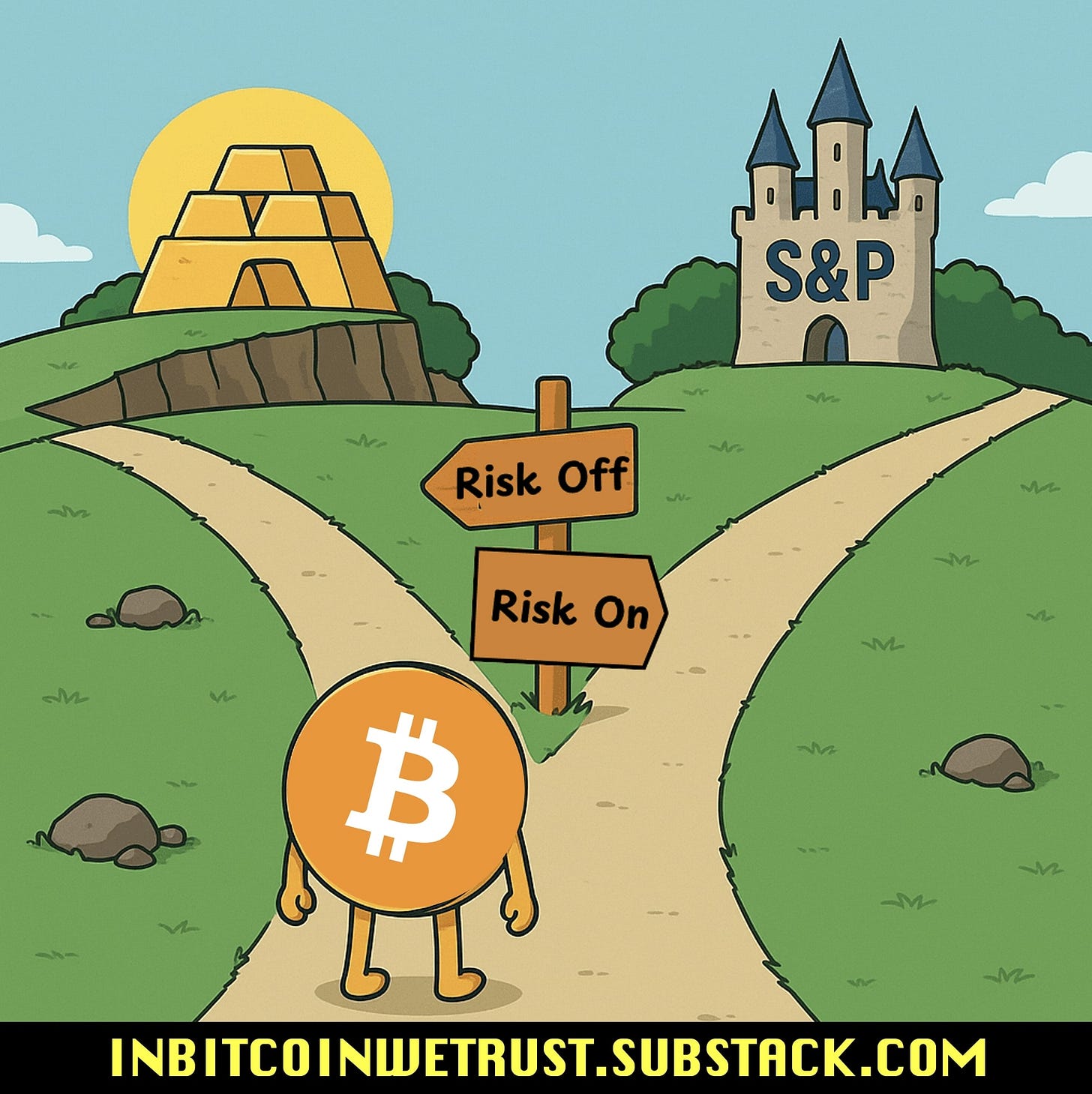

Time Is on Bitcoin’s Side – Investing in Bitcoin Has Never Been So Risk-Off.

Here are the 4 main reasons.

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.