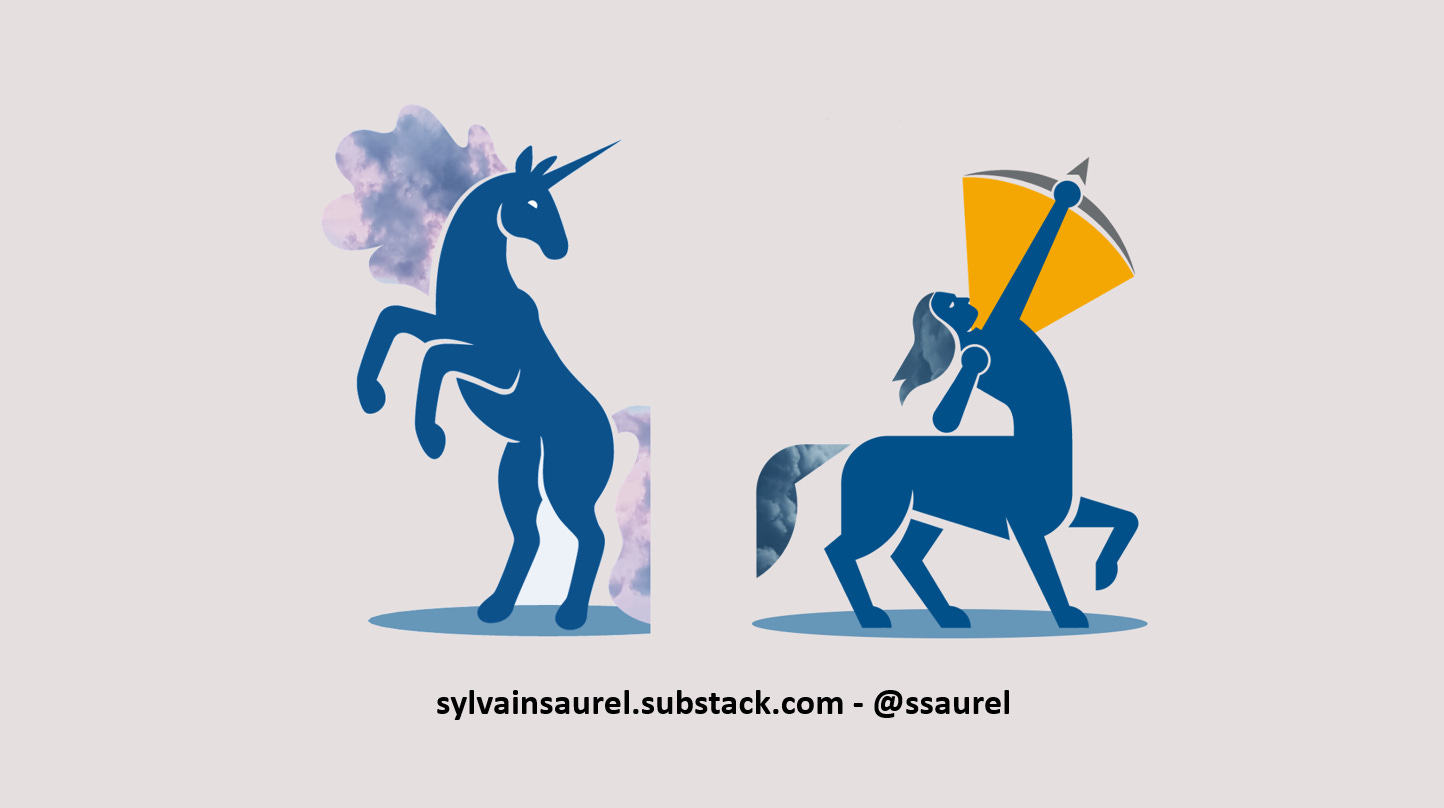

Investing in Startups – The End of the Unicorn Concept, the Rise of the Centaur Concept.

Centaurs are startups generating at least $100M in ARR.

Bessemer Venture Partners has just published a report entitled “State of the Cloud 2022” which proposes to stop focusing on the valuation of software startups (SaaS). The authors of the study call for a change in mindset:

“Historically, valuations have been the primary measure of success in private cloud markets. But the unicorn rush is getting out of ha…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.