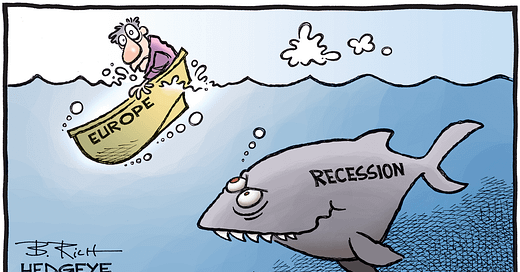

Headwinds Around the World, but Different Economic Challenges in Different Countries.

Serial recessions are to be expected.

For many weeks now, a nagging question has been coming back with insistence: is the world heading for a recession?

In their forecasts published at the end of July 2022, the IMF experts explain that a fall in activity is not their central scenario (despite the decline recorded in the spring of 2022) before affirming that “the risk of recession is particul…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.