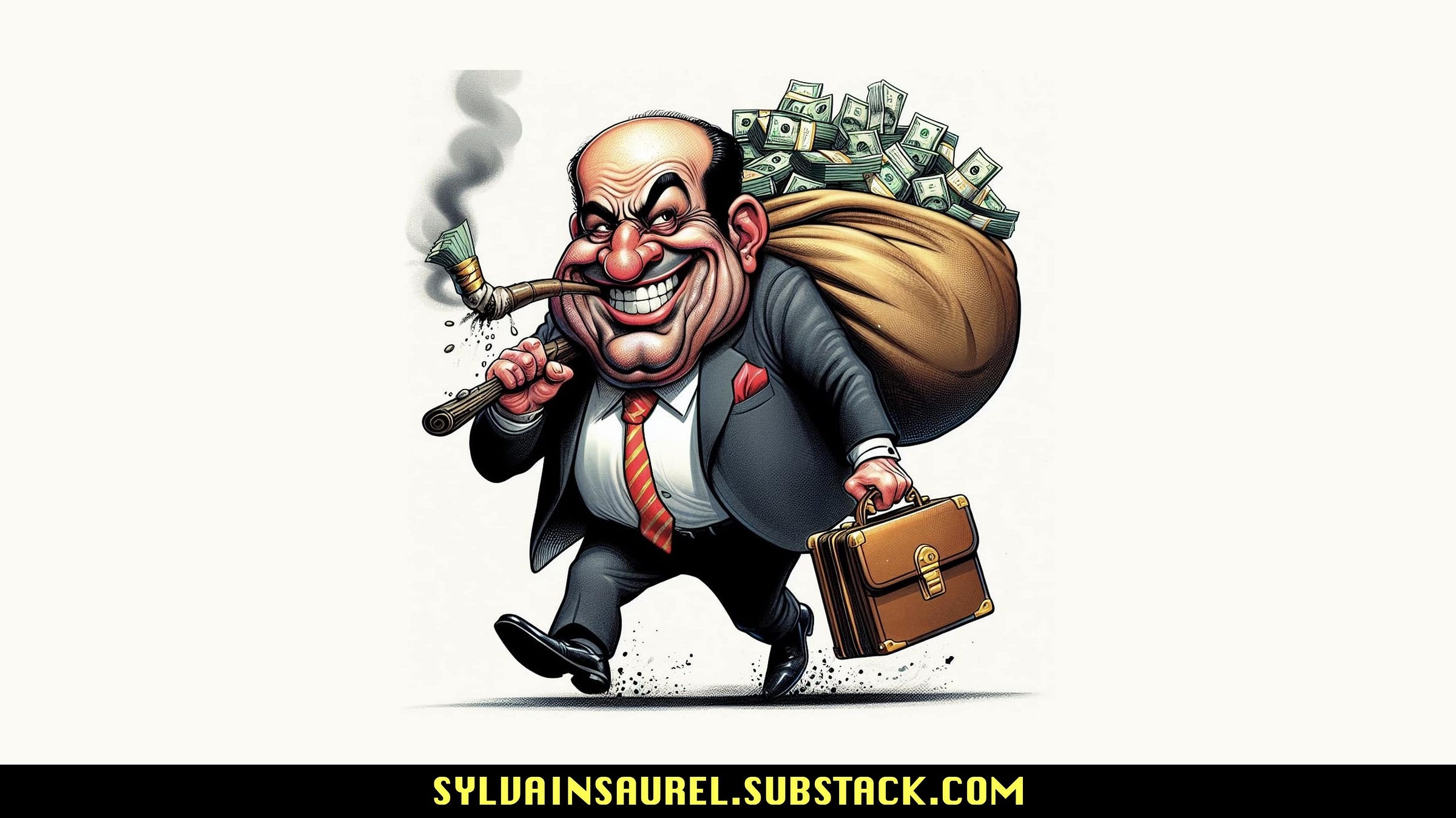

For Investors – Beware: Ponzi Schemes in the U.S. Rise 50% to $3 Billion in 2024.

Once again, beware. Stay safe!

At the end of the 19th century, former American presidents did not benefit from a pension. This was only introduced in 1953. So it was that Ulysses Grant, the 18th President of the United States, thought about how to grow his savings after his time in the White House. On his son's advice, Ulysses Grant invested $50,000 (equivalent to $1.5 million in today's money) in a company that was to invest in the fashionable assets of the day: railroads, mines, etc.

Ulysses Grant was lured by the guaranteed 2 to 3% monthly return. But his manager, Ferdinand Ward, known first as the “Young Napoleon of Finance,” and subsequently as “the Best-Hated Man in the United States,” was a swindler and forerunner of Charles Ponzi. He also swindled the Vanderbilt real estate magnate before fleeing. Of the $50,000 invested by Ulysses Grant, only $210 remained. Ferdinand Ward was sentenced to 10 years in prison, but like Bernard Madoff more than a century later, he showed no genuine regret.

With financial markets on the rise in 2024, investors were less wary. Their greed and avarice allowed the swindlers to prosper, dangling the prospect of quick fortunes without any effort on their part.

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.