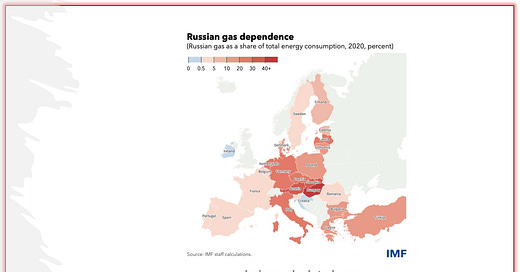

EU Anticipates a Complete Shutdown of Russian Gas – IMF Details a Varying Impact Between Countries.

The EU can cope with up to a 70% drop in deliveries.

The Italian Mario Draghi was in Algeria on Monday 18 July 2022 to secure gas supplies. On the same day, we could discover a trip of the president of the European Commission, Ursula von der Leyen, to Azerbaijan to double in a few years the gas imports. Then it was the conclusion of an energy partnership between France and the United Arab Emirates.

The Eur…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.