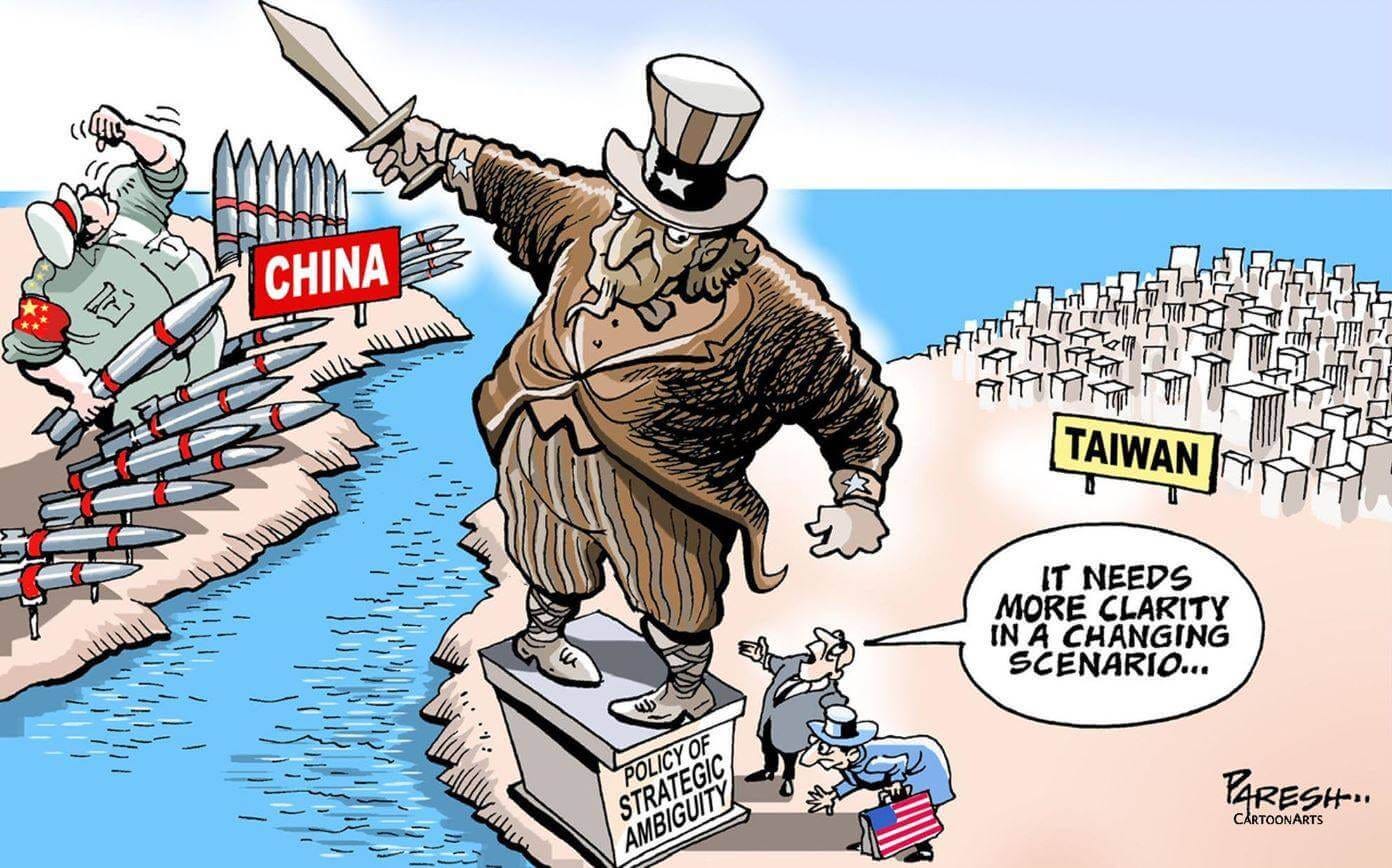

Don’t Be Fooled, Nobody Has an Interest in a War in Taiwan, Neither China nor America.

The reasons are different, but both giants will do everything to preserve the current status quo.

Nobody has an interest in a war in Taiwan.

I'll say it again, but it's obvious. Except maybe for some ultra-belligerents from the CIA, the Guoanbu (Chinese secret service), and the FSB (ex-KGB), nobody has an interest in a war in Taiwan.

Not only because it could trigger the third world war, which would reduce the planet to nothing and thus solve all of h…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.