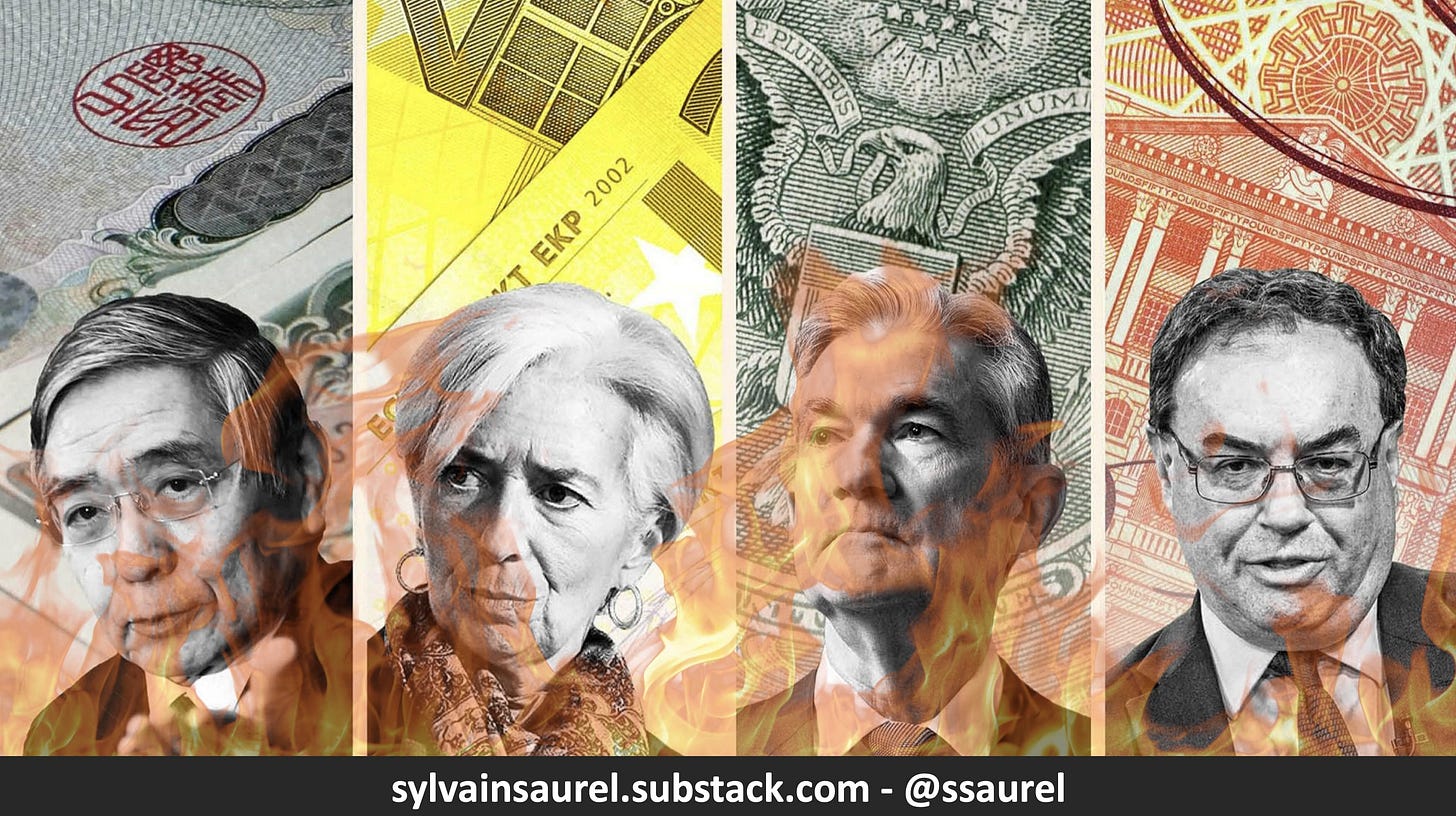

By Dint of Acting As Firefighter Arsonists, the Fed and the ECB Have Burned Themselves …

... and we will have to pay the price.

For those who take the time to follow the economy closely enough, one reality is obvious. This reality is certainly one of the worst news of the last few years. While in normal times, central banks are supposed to be the guardians of the temple, i.e. of economic and financial stability, they have become dangerous firefighter arsonists. This is even more…

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.