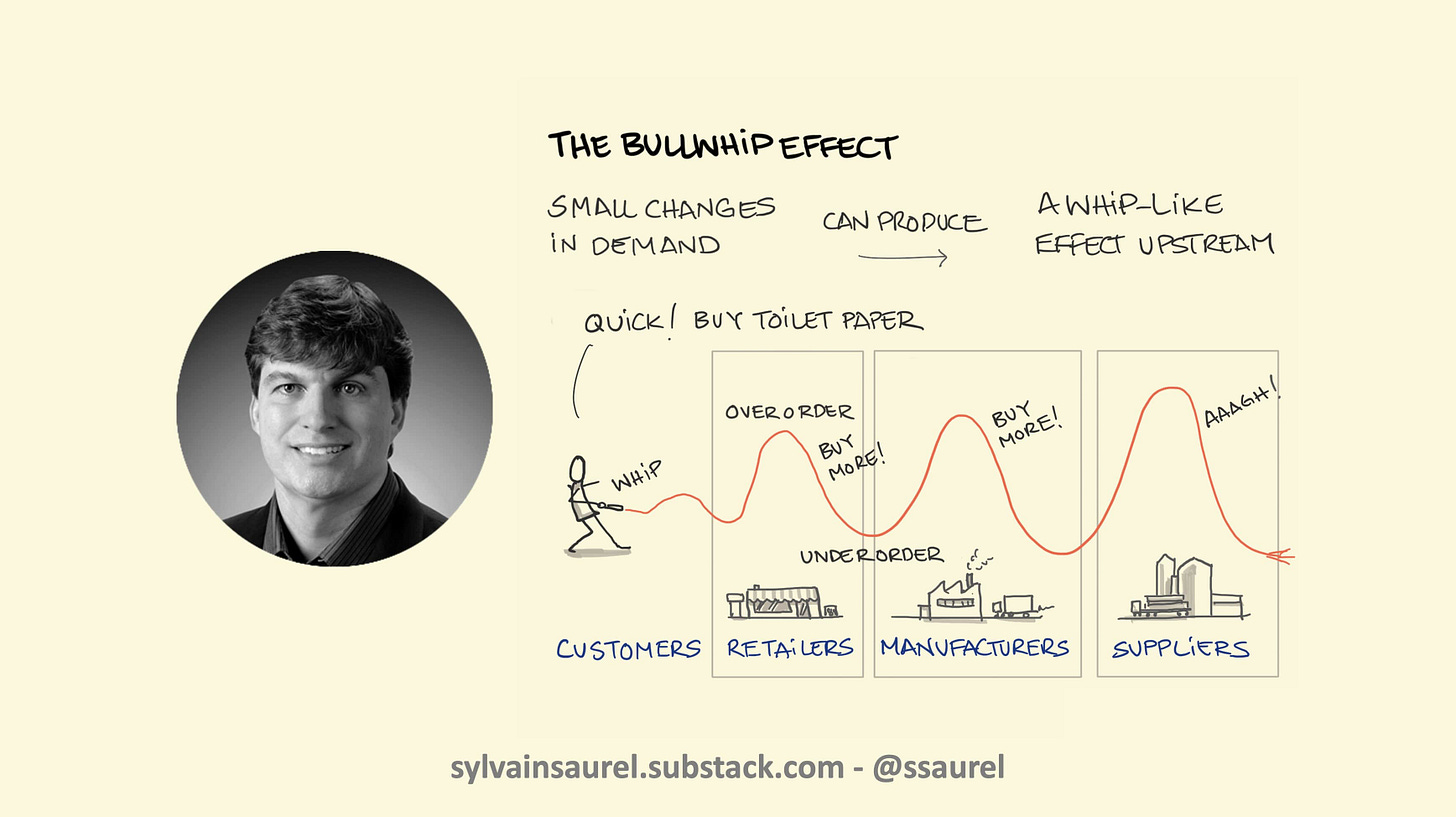

Always a Contrarian, Michael Burry Predicts a Bullwhip Effect in the Months to Come.

Some of the economic data in America point in his direction.

While everyone is saying everything and anything these days, talking about recession, stagflation, hyperinflation, or even the Big One, Michael Burry is once again standing out. Always a contrarian, the man who saw the subprime crisis coming before anyone else sees a different scenario than increased inflation and endless rate hikes by central banks in …

Keep reading with a 7-day free trial

Subscribe to Sylvain Saurel’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.